Revenue Cycle Management Services

Outsource Revenue Cycle Management Services to the Expert

Cyctems is a specialized revenue cycle management service provider with over 25+ years of experience. Over the years, we have assisted hospitals, clinics, and physician practices in streamlining their services for better revenue control. Our end-to-end RCM service covers medical coding, billing, records indexing, claims processing, payment posting, denial management, and accounts receivables.

Our team is driven by certified billers, coders, and revenue cycle specialists. We develop kpi-driven workflows and power them with cutting-edge tools and technologies like EHR systems, RCM software, and predictive analytics. This ensures an automated and streamlined process with reduced errors, minimized gaps, and enhanced revenue generation.

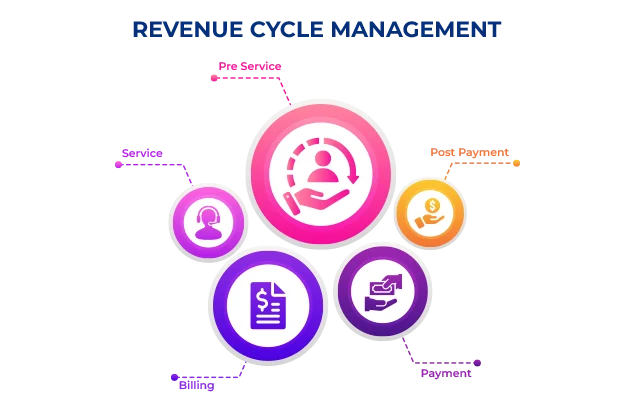

Revenue Cycle Management Processes

Patient Registration

- Gather patient demographic information, insurance details, and other relevant data and update the system.

- Accurate and comprehensive registration information is crucial for smooth billing and claims processing.

Insurance Eligibility Verification

- Verify the patient's insurance eligibility. This step ensures that the services will be covered by the insurance plan and helps in identifying any potential issues with payment.

- Verifying insurance eligibility minimizes claim rejections and reduces the risk of financial surprises for both the patient and the healthcare provider.

Coding and Documentation

- Medical coders assign specific codes to the diagnoses, procedures, and services provided to the patient.

- These codes translate the services into a universally recognized language for billing and claim submission.

- Proper documentation should support the codes chosen, ensuring compliance, and reducing the risk of claim denials.

Claims Submission

- Claims are submitted to insurance payers electronically.

- The claims are customed as per specific payer requirements, including proper formatting and the inclusion of necessary supporting documentation.

- Claim submission is done through electronic data interchange (EDI) or clearinghouses, depending on the payer's preference.

Payment Processing

Upon receipt of the claim file, insurance payers review and process them. This step is known as payment processing or claims adjudication. Payers assess the claims for accuracy, medical necessity, and adherence to coverage policies. They determine the amount to be paid by the insurance payer and any patient responsibility, such as deductibles, co-payments, or coinsurance. Payments are received either through electronic funds transfer (EFT) or checks.

Denial Management

- Some claims are denied or partially paid by the insurance payer.

- Identify the root cause of the denial or partial pay.

- Establish corrective steps (as complete documentation, coding errors, or lack of medical necessity) and appeal for reimbursement. Follow due process of appeal as per insurance company.

- Implementation of preventive steps to avoid similar denials in future.

Patient Billing and Collections

- Patient billing includes generating and sending clear and itemized statements that detail the services provided, insurance payments, and the patient's financial responsibility.

- Various payment options, such as online portals, credit card payments, or payment plans, can be offered to facilitate prompt and convenient collections.

- Claim submission is done through electronic data interchange (EDI) or clearinghouses, depending on the payer's preference.

Accounts Receivable Management

- Accounts receivable management involves tracking and monitoring outstanding payments from both insurance payers and patients..

- Timely follow-up on unpaid claims and patient balances is essential to optimize cash flow and minimize aged accounts receivable.

- Regular analysis and reporting on the aging of accounts receivable help identify and address potential bottlenecks or issues in the revenue cycle.

Financial Reporting and Analysis

- Key performance indicators (KPIs) such as collection rates, days in accounts receivable, and denial rates are monitored to measure the financial health and operational efficiency of the organization.

- Establish corrective steps (as complete documentation, coding errors, or lack of medical necessity) and appeal for reimbursement. Follow due process of appeal as per insurance company.